What does it take to truly be customer-centric and show results? By understanding and quantifying the unmet needs of the customer, you are taking the first step towards results-driven customer-centricity. Most people think they solved it. If so, you are growing and demand exceeds your supply. Here are some ideas and suggestions if not.

Step 1 and part of every step: why?

Customer centricity is about understanding why people selected you. What are the deep motivations and reasons? It’s about having a clear organizational mission and vision and finding people that have the same mission and vision in their lives whether it’s business-to-business or business-to-consumer. That is the start.

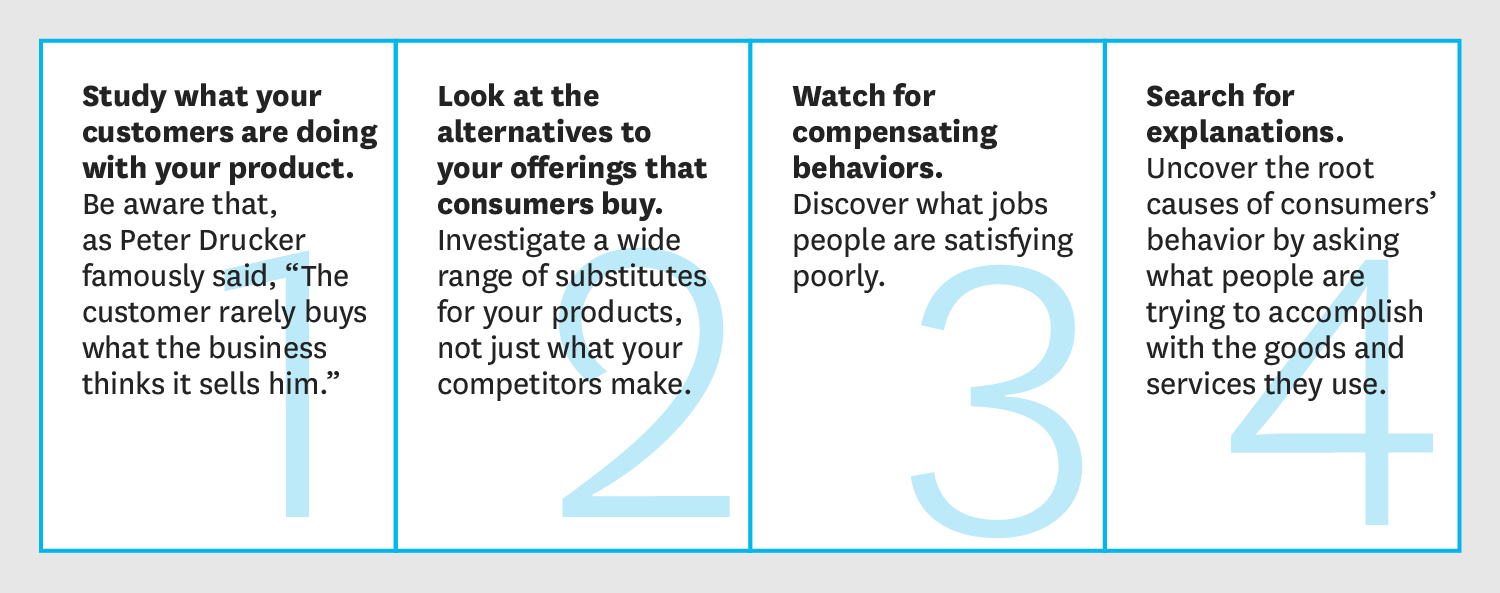

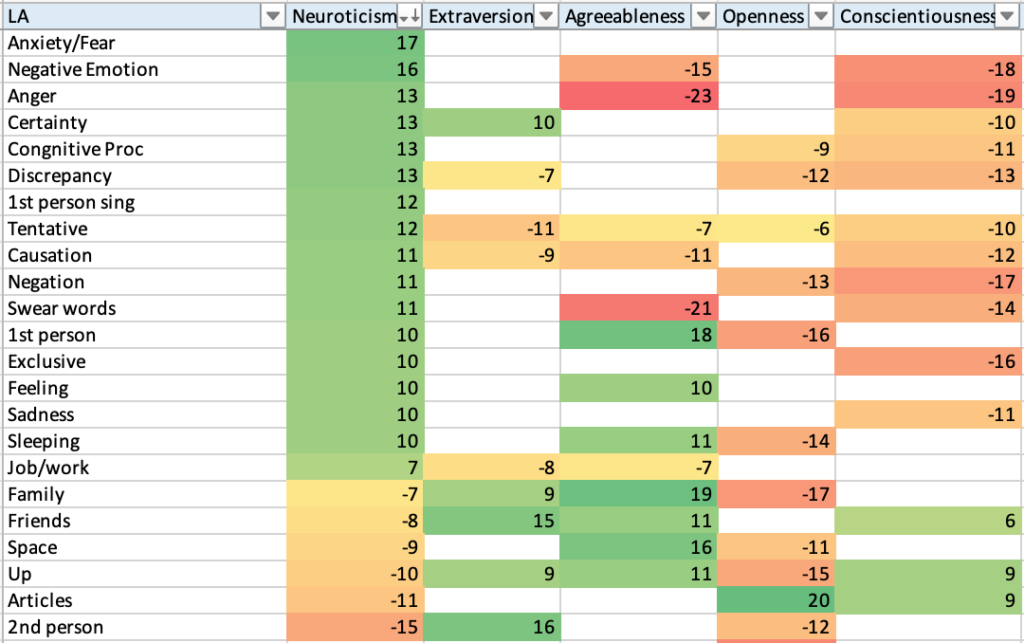

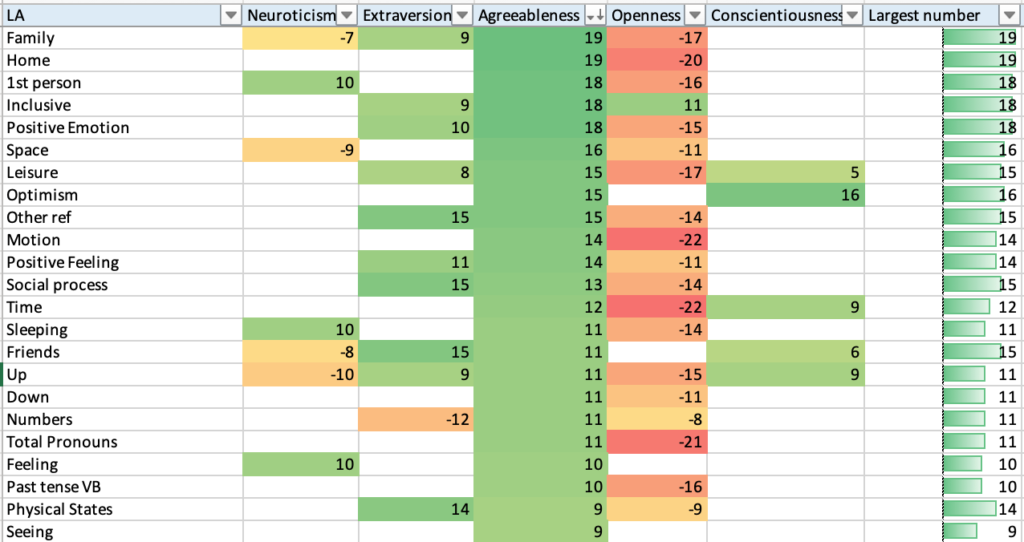

As Clayton Christensen once pointed out, jobs-to-be-done, a concept that inspires me, has three core elements. There is a) functional, b) social and c) emotional dimensions. There is only a finite set of these that are causal to ‘why they buy’. I consider social and emotional dimensions to be traits, that are defined by who we are from a very early age. Traits are not emotions, they don’t change overnight. If you woke up as an honest person today you probably will be waking up as an honest person in 10 years – traits matter, emotions are temporary states. While useful, my research indicates they are rarely causal to buying something…with profits attached (Ok, I do buy ice cream for emotional reasons). There are hundreds of traits that connect well to your products. The functional reasons why people choose you can also be uncovered and predicted in unique ways. For example, you might be a gardener. About 40 million people in the USA are. But gardening is not just about pretty flowers. Sometimes, it’s therapy. What Home Depot sells can be viewed as the ‘easy side of gardening’ but if you go down a certain aisle it’s more like a replacement to meds. Why you go down certain aisles at Home Depot is complex, what you buy will be causal to your traits.

Step 2: Psychology based economic framework

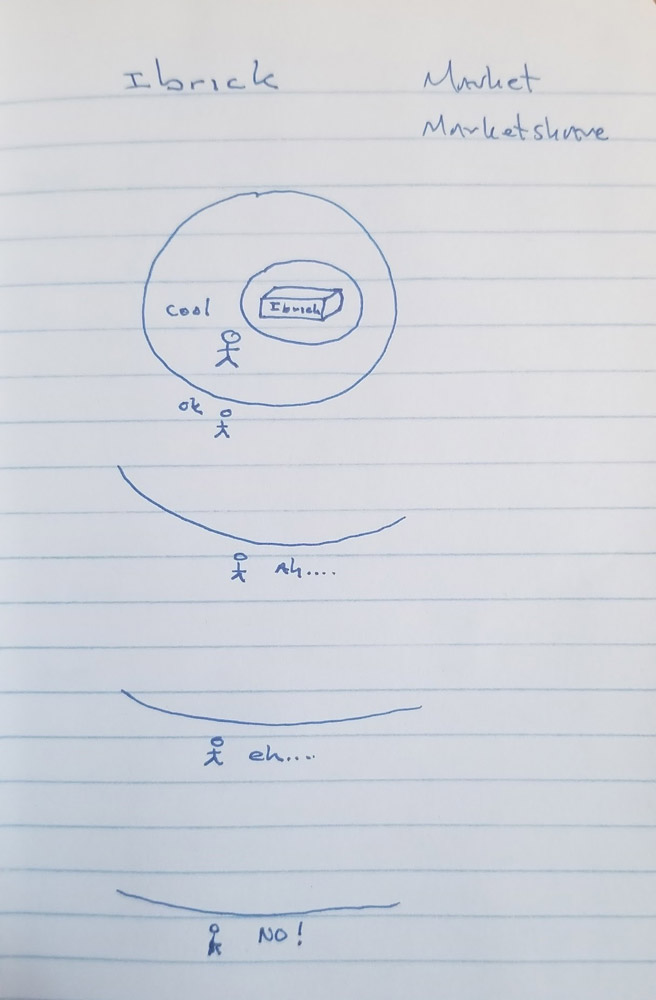

The alignment of ‘why they buy’ with the ‘math’ of the business collapses the friction and noise that typically exist in lesser business models. Companies that transition into a customer’s psychology driven approach, implement a way of thinking at all stages and areas of the company. Everyone is impacted. The most important part is the economic framework, balancing what the customer wants with the needs of the organization. Technically speaking, you’re balancing ‘customer delight’ as a KPI with customer equity, as a KPI. It’s the balance that matters most. If you know your existing tribe of customers and can create a look-alike audience that is precise and based upon customer psychology, you have a baseline model on what it takes to reach maximum market share.

Step 3: Getting the organization right: How much change: people, products, technology?

Do you have an organizational challenge? If people require a lot of change, how they think about the business, yes, you may need consulting or some change agent. You need to have mentorship, interception, and implementation for change to work. Is that how you would describe your organization? If you need ‘people help’, well, consulting helps a ton but it’s incomplete. Consulting takes time and it’s not as data drive as it should be. If you have data-driven consulting, it’s likely not as fast as it should be.

Do you need technology or data to get to this better state? Likely, yes and no. If your organization is ready for change or designed for change all you’re going to need is a set of data that is truly predictive in nature. It’s not ‘data of the past’ that will solve the problem. If your people are ready for it, your workflow is likely already in place, all you need is a means to predict the future WITHOUT data from the past. Understanding people at a very deep level and why they buy from you change everything from sales to product development and everything in between. Having more data about people and transactions, what they click on, and what they visit is not the answer. Companies are awash in data and yet there’s so much information without results. Innovation and growth are often disappointing with the wrong business framework. Why is that the case? It’s because the data that is most helpful is a) hard to get and 2) appears irrational out of context.

The things that are going to truly benefit your company and be helpful to your existing workflow are characteristics of customer motivation, psychology, and traits.

Step 4: bring it together

Once you have customer psychology data, predictive capabilities, and the organizational alignment done, the tasks of tradeoffs start. You can’t wait for perfection, so tradeoffs likely start somewhat misaligned. That’s all right. It’s just reality. What will matter is creating a scorecard and starting to assign measurable changes to all areas of work.

Step 5: look out for the issues

If you’re thinking in terms of media buying you’re not customer-centric.

If you’re thinking about how hard you can squeeze a customer, you’re not customer-centric.

If you’re trying to correlate data and not fine the causal reasons, you are not customer-centric.

If you keep hiring data scientists and handing them only ‘data of the past’ to model, you’re not customer-centric.

There’s ways to make significantly more money by not thinking the ‘old school’ way. If you have not embraced that, you’re not customer-centric.

If you’re looking for more efficiency from the world you already know, you’re living in 2019 or earlier.

If your are embracing complexity as the only answer to discovering customers, building ever more elaborate models, you would likely are looking at a bunch of noise.

If you’re doing surveys, be careful with the questions you asked. It could mislead you.

If you’re doing interviews, be careful because the people could be the wrong personalities. Those willing to give information to you or incentivized the wrong way could guide a company into a black hole.

Of all the new product launches only single digits make it to the next year. Very few products ever scale. There is a framework you can adopt that gives you a significantly higher chance of success and it starts with the deep understanding of people.

Embracing practical, customer-centric innovation gives you the opportunity to achieve and outperform competitors. It’s time to remove the guesswork, empathetically understand people without creating bias, implement prediction into an existing workflow, create focus, and drives far netter results than ever before. Don’t settle for the old way – it’s done.