Another way to describe it: Making predictions when data fails you.

The really fast answer: when the rules are static and well described, the machine gets it. Example: IBM winning chess matches. When the rules change or even when the game changes, good luck. What do smart people do that allow them to survive and some thrive in this environment?

Another example of fails: elections. Often wrong because so many factors that are poorly described are not understood.

Historic data is great and when the rules are clear, you can predict. For example, if I buy a printer, within so many ink cycles, someone can and should predict when I should order (in my best interests). Recently, I got an email from CarFax predicting the need for a change right at 2% oil life remaining AND the car is NOT connected. Is this useful? Yes. Is this a real prediction? I don’t think so.

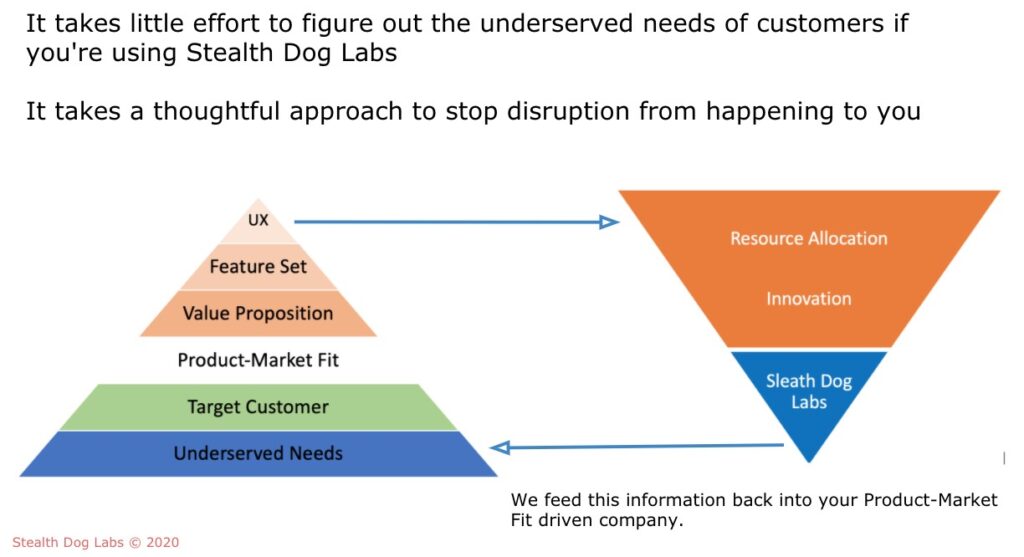

When flawed or incorrect historic data exist, turning the tasks over to AI or ML will not solve the problem. Fitting models or collecting more data is not the answer.

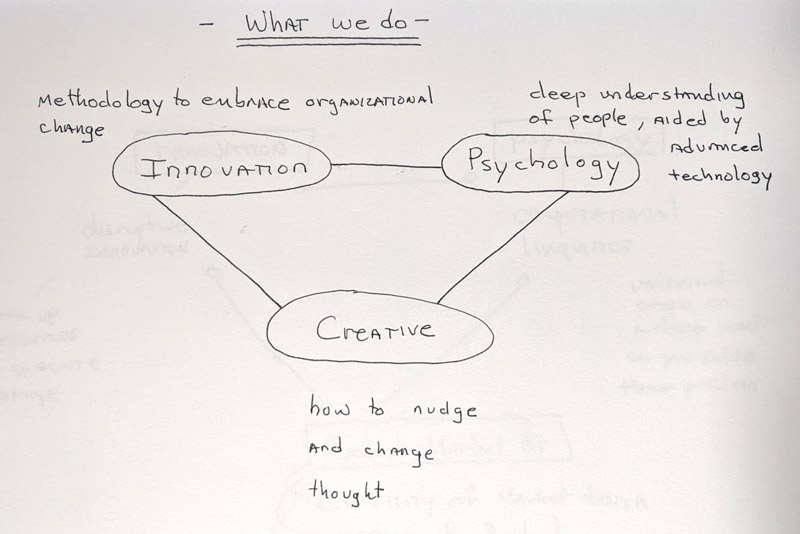

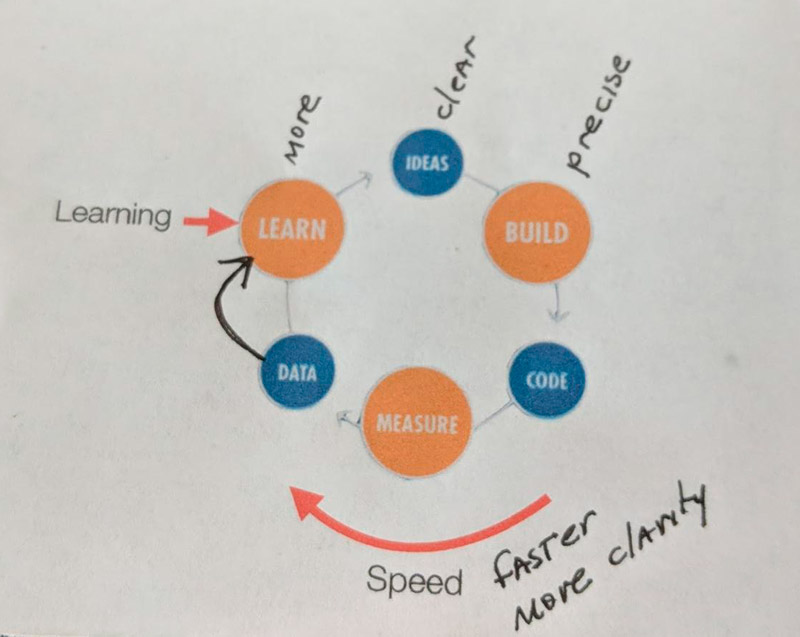

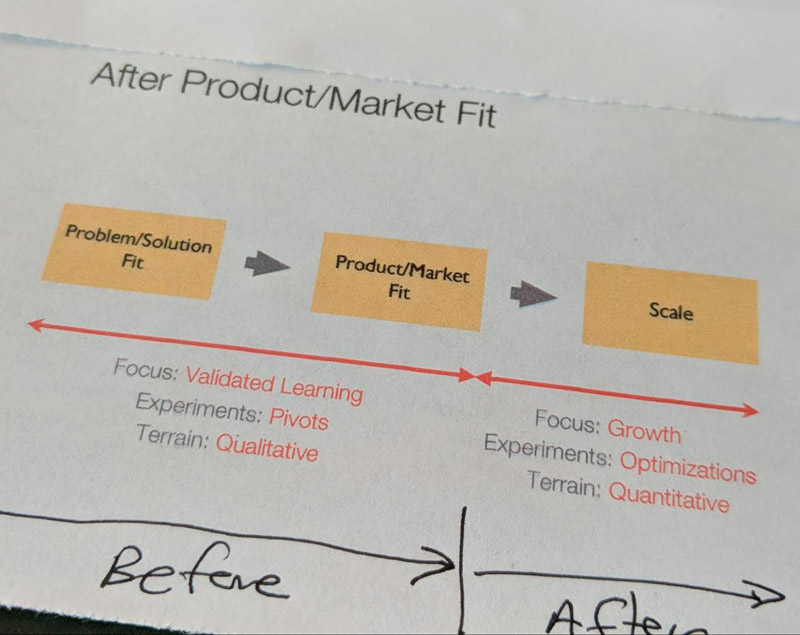

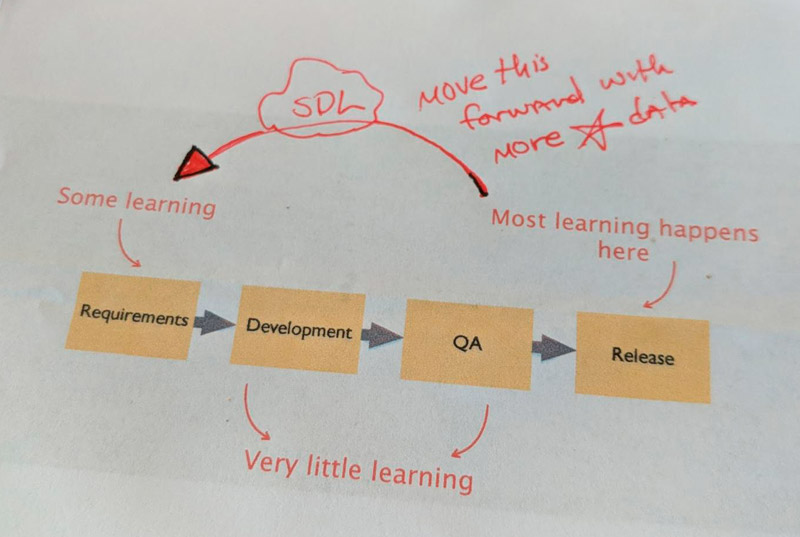

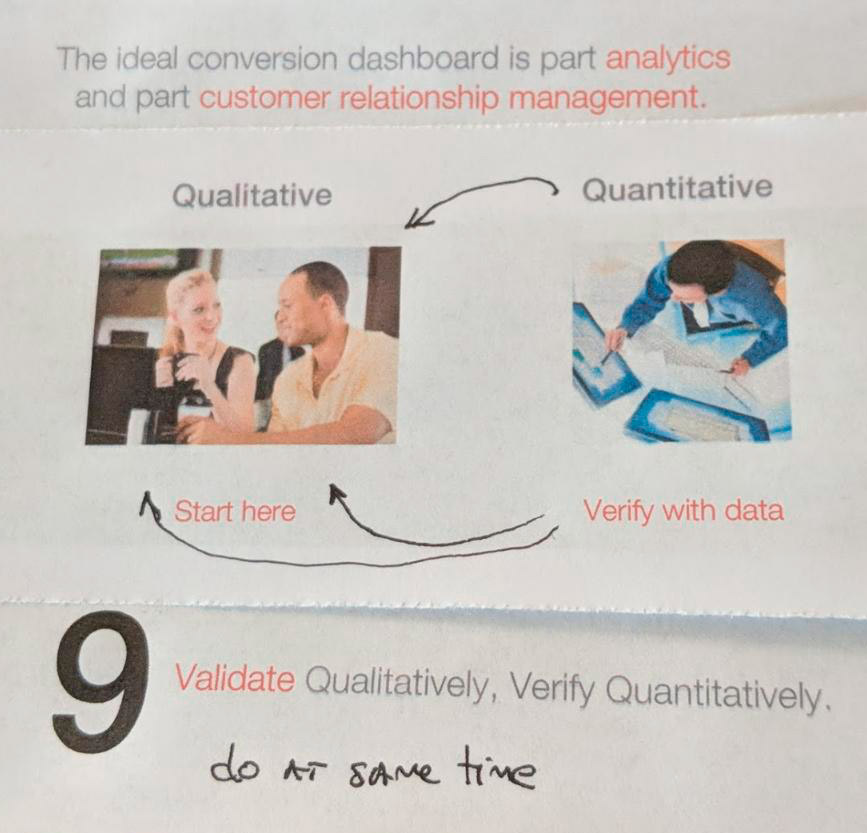

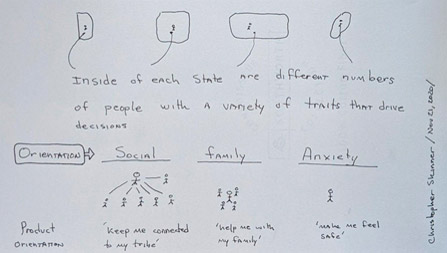

What does work is creating data based on theories that are causal to outcome. Even if you don’t have the actual data to prove it, a theory that is causal is likely more valuable. When that theory based data is connected to historic data AND you have the right math to connect the two, you got it.

Some people use a concept called transfer learning, which attempts to connect one domain to learning to another. I think that is very useful. The idea is to identify a set of learnings from one domain to another. That is what I did to create a hypothesis of personality traits for people where I have no real time data. Once you have this causal relationship mapped, you can form a connection and identify “proof points” to help the concept work.

One example might be polling for elections. Pollers should look at things besides voluntary requests for who you voted for. We are well past that. When will brands and commerce realize the same problem exists in their world. Hard wired, collelative data is not going to keep them afloat.

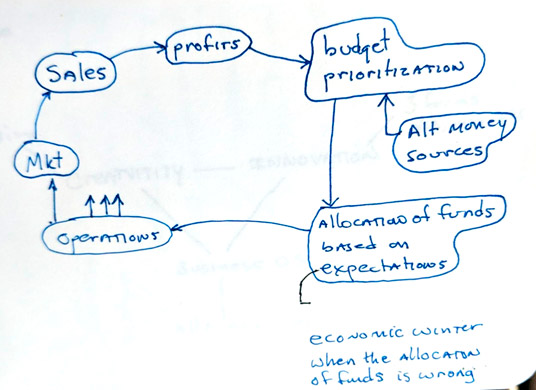

We have an increased need for new ways to adjust the quantity and quality of data within the organization. The math is also well overdue for revision. So, as a business leader, ask yourself, are you relying on historical data? If you are you may be ignoring the future.