By Akos Tolnai and Christopher Skinner

Go to market strategy was a stronghold, captained by marketing. The more you could spend on marketing or, in general, customer acquisition, the steeper the growth curve would be.

Or to put it this way: even a mediocre product could become a success with substantial marketing spending.

The last decade has changed this status quo.

Perhaps that change began with the controversial introduction of Samsung’s first smartwatch, Gear, in 2013. Samsung’s marketing budget was one of the biggest by that time, both in terms of total amount as well as proportionately compared to revenue.

But Gear didn’t perform well. Samsung claimed to have sold 800 000 units, with local sources raising doubts about the validity of this number. Moreover, quality may have also been compromised: according to reports, Best Buy experienced a previously unheard of 30% return rate. More details on this in the Gear Wikipedia article.

And this particular story isn’t unique at all in the last decade. Or defining “decade” more precisely: the period between Lehman Brothers and Covid. Flops galore, they all boil down to product-market fit and the results of poor product-market fit. How? Why?

We think two dynamics are to blame for these flops—changes in customer behavior and general business constraints.

- Rise of Moment of Truth

- CAC rising

Moment of Truth

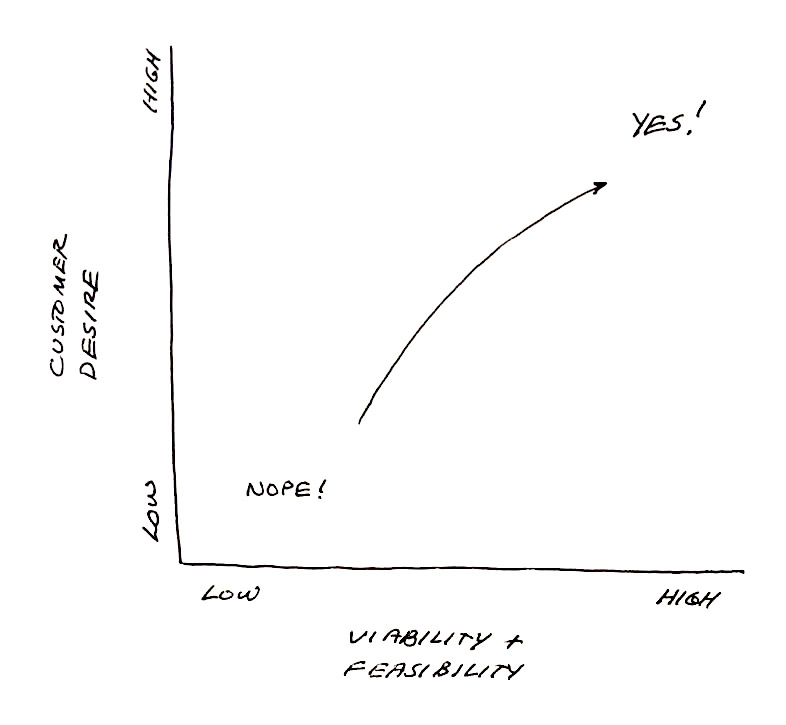

There are only two types of products (or services) in the world—those with the “moment of truth” ‘halo’ and those without this halo.

What is Moment of Truth?

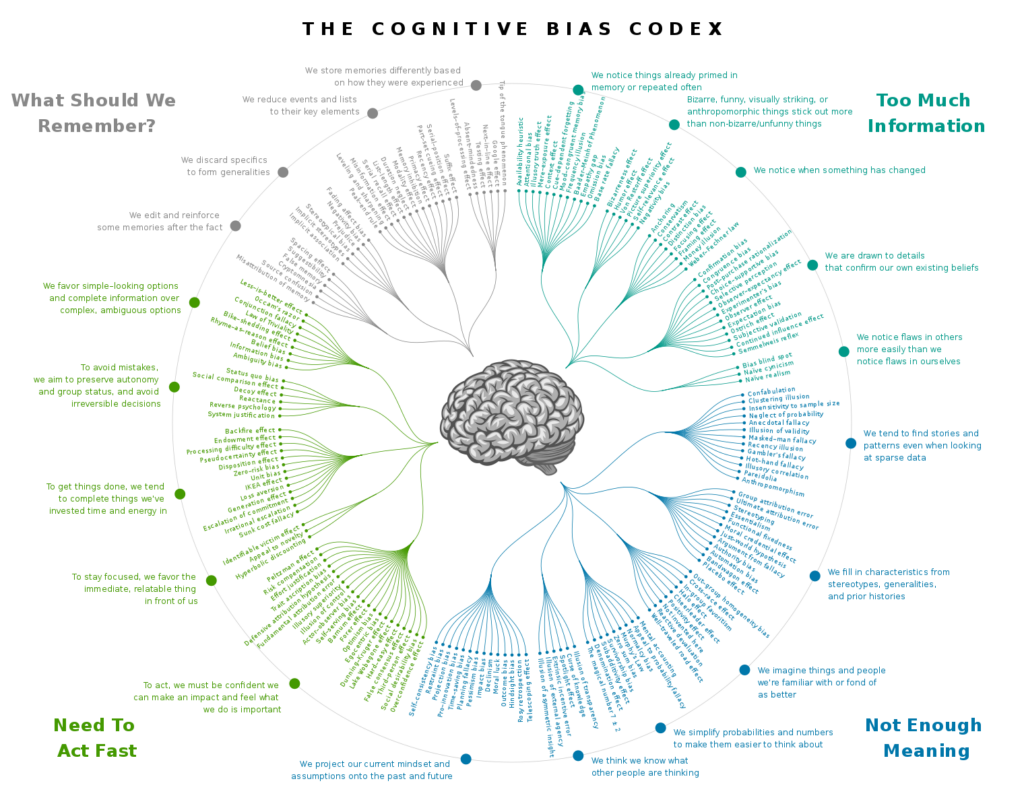

Marketing communication is about hitting the right target market and customers with the right message. It is usually not an impossible task for seasoned marketers, even though their work is more complex and costly than before. In a business with a moment of truth the marketing message is validated. When you buy something, you definitely realize the marketing promises or hype is true or not. You decide for yourself. The marketing lingo (a.k.a. Marketing bullshit) gets tested against the product’s reality.

The promise of “Great battery life,” or is it not? Great performance with all-day battery life, when in reality, you maybe get to noon? You either return the product or start complaining about it on social media, in Amazon reviews, or to friends. The problem is exacerbated for services. Superfast internet? Best in class customer service? 99.5% uptime? Or are you “re-accommodating the customers”? Good for you. You are now entrenched in customer experience training around the world.

Understanding the importance of ‘moment of truth’ and customer experience cannot be overstated.

Customer Acquisition Costs

Is digital advertising becoming cheaper?

At least that is the mantra you hear every day. You can start advertising with a $100/day budget. Customer acquisition cost is declining, right? Most likely not. Much of this problem has to do with attention of the user. The price of one single ad might become lower, but to have a focused eyeball, a “committed” eyeball, is significantly higher. Not to mention you have to add the price of the noise, the cost of bad reviews, timing cost, etc. The price of a click is dependent on the cost one is willing to pay. And if one of the players has an endless bag of cash, you are outperformed.

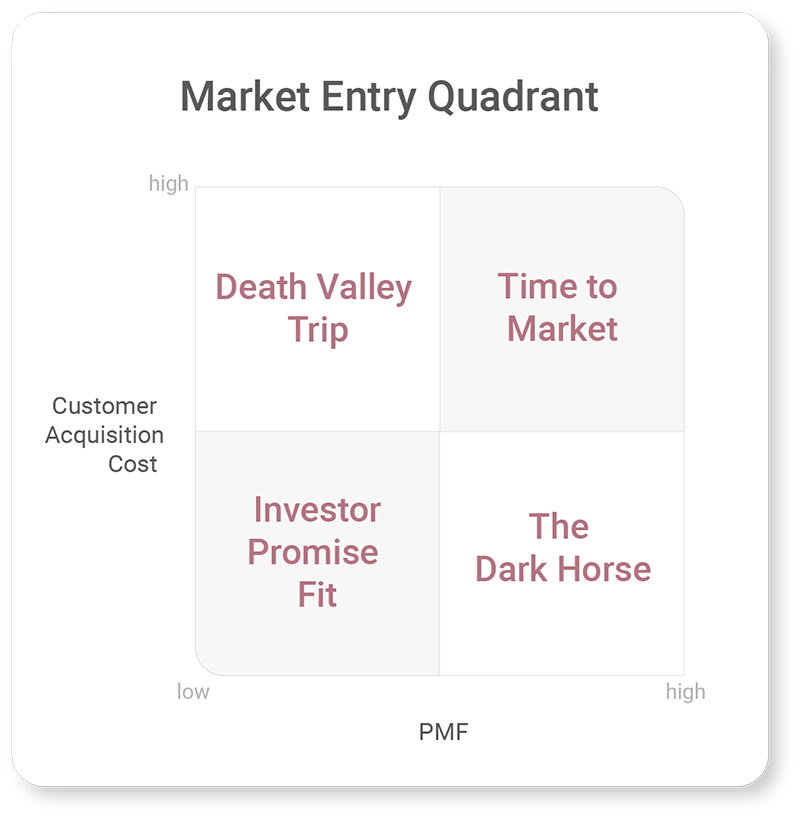

The PMF-CAC (Spending) Quadrant.

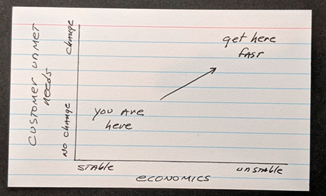

We tried to summarize what was and what is in the following chart:

Low PMF – High budget

Twenty years ago, you could market your product with mediocre Product-Market Fit and a huge marketing budget and do well. A proponent of this approach was Microsoft, who could keep pouring immense amounts of money on marketing until they educated the market, and the product reached a natural growth trajectory.

Today this will result in instant failure, at least when calculating the ROI. Innovators, startups, or companies with capped marketing budgets will falter if they end up in this part of the chart.

Low PMF- Low budget

You might get lucky, and your product finds a second life. The initial value proposition failed, but someone, most likely an influencer, will pick up your product, use it for something else, and make it chic, building hype around your product. You will get a substantial return, but growth will have a glass ceiling.

High PMF – High budget

In this quadrant are the companies who have found their niches and have the budget to “out-advertise” everyone. They pour endless amounts of money into customer acquisition, regardless of channel (partner network, advertising, retail, salesforce). You are on track, and all you need to do is put the pedal to the metal. You know the metrics, and you know the algorithm that will result in the best effects possible—the road to world domination.

High PMF – Low budget – The dark horse

You know more about your channels and customers than your results predict. You didn’t have the pressure to grow before coming to terms with your Product-Market Fit. You focused on customer psychology, buying behaviors, and persistently created the feedback loop to make a better product or service based on target niche feedback. You grow niche-by-niche, as exemplified by Geoffrey Moore’s Bowling Alley strategy. From here, world domination is just a sizeable marketing budget away. It’s the often told dream that is rarely seen. We read about these stories, but most likely, you don’t see these examples in your world.

The path to success

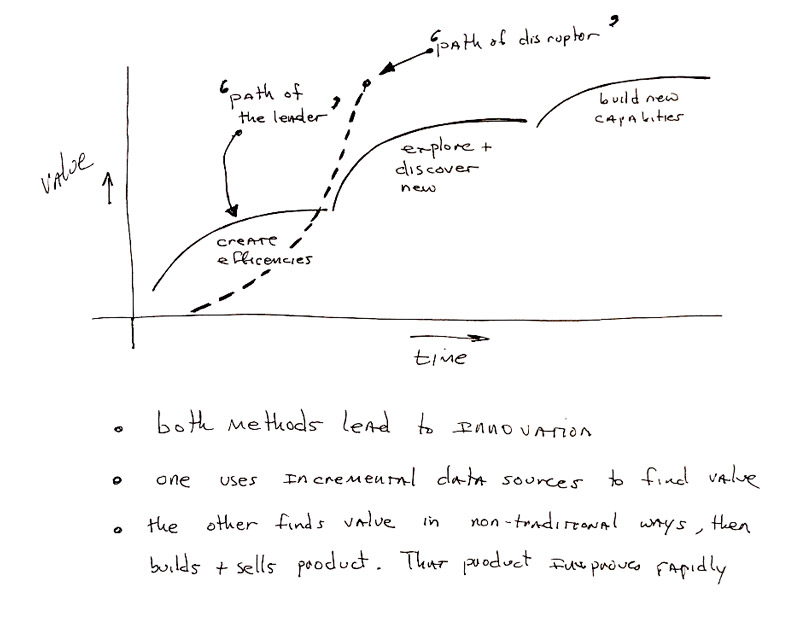

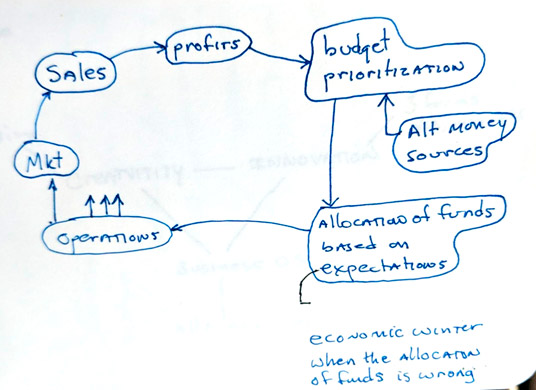

If you look at current startups and innovators, the path is usually as follows;

- Low PMF – low budget – investor comes in, and it’s now called “Investor-Promise Fit”

- Low PMF – high budget – Death Valley trip, aggressive growth stage; high and growing CAC

- High PMF – high budget – aggressive growth stage, lower CAC

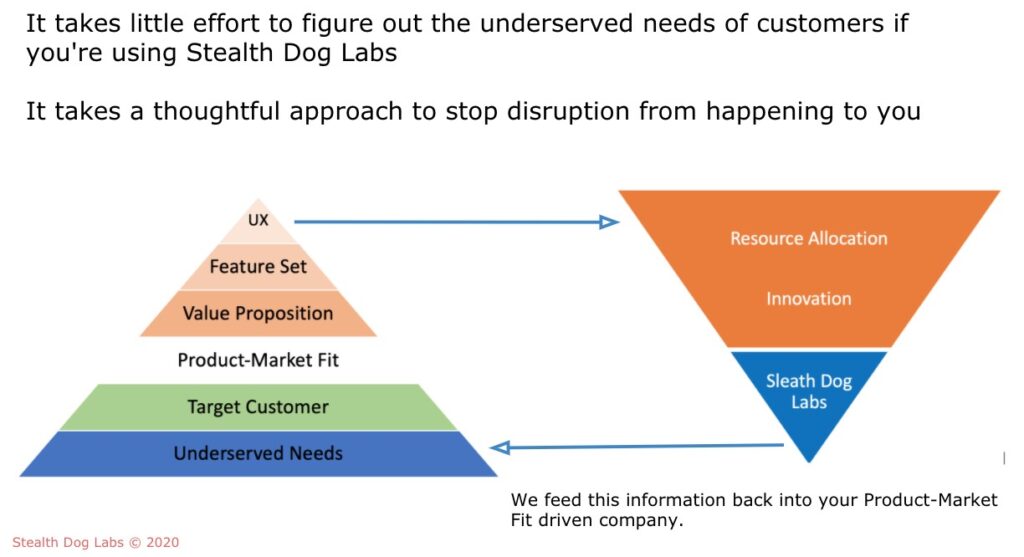

Instead of the above, you could opt for an under-the-radar strategy, in a more resilient, more grinding, and focused way of finding high PMF first and moving with or without external funding to high PMF – high budget phase. It is the “way of the cockroach,” the new startup kung-fu, where the higher PMF is essential to remain profitable.

Understandably, VCs have a problem understanding this as well. Coming from the first 20 years of the internet age, if you had money, you could eventually get to PMF. In 2020, having money to get to PMF means having LOADS OF MONEY, which most companies cannot afford.

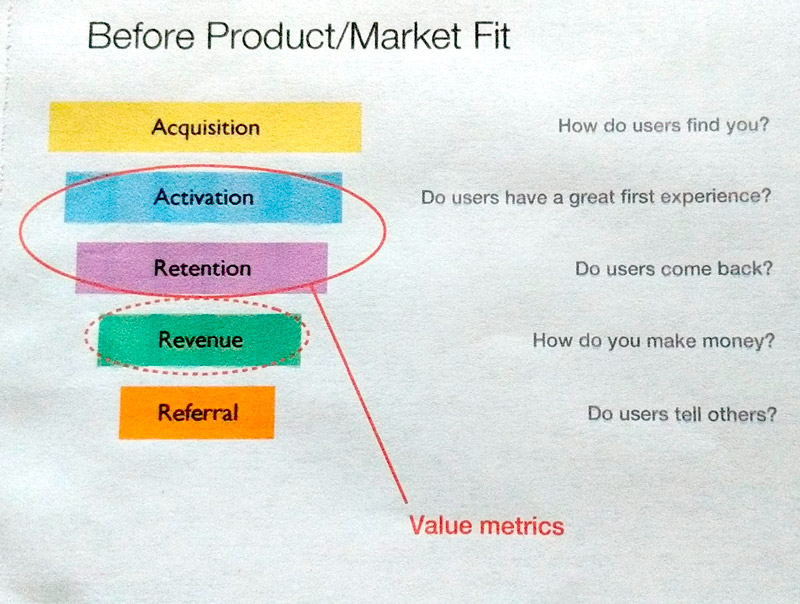

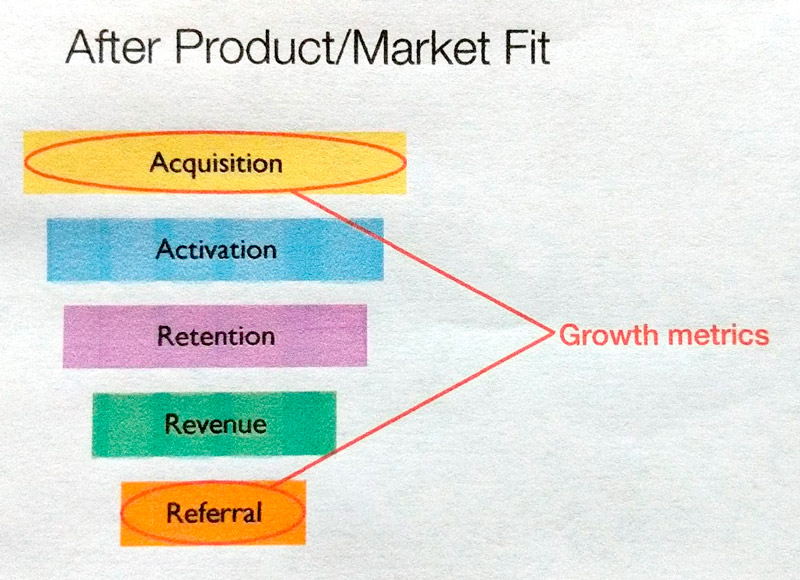

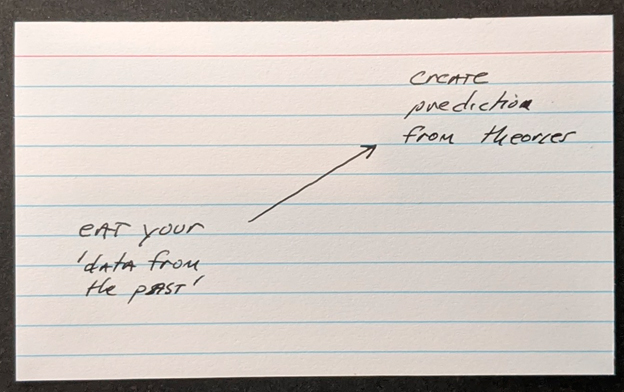

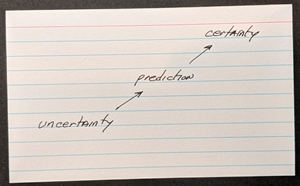

Any innovative product has a limited time to show its viability. And in this limited time, customer acquisition becomes extremely important. How do you acquire customers? What should the growth trajectory be, given the above problems? We believe making

Product-Market Fit a priority at the executive level has come. It will be the most important topic discussed in boardrooms, innovation centers, and VC meetings. We believe the first ones focusing on true PMF will emerge as superstars of the next 10-20 years.

Still to come:

How to get to PMF using psychometrics and customer experience.