Why do some companies enjoy accelerated and sustained growth in defiance of supply-chain glitches, rising inflation and political disruption? Are they just lucky?

After analyzing 30,000 businesses and millions of leaders over a 15-year period, business model expert Christopher Skinner believes he has the answer. It doesn’t involve capital, a stellar business plan or genius marketing.

“It’s because of who they hire,” he says.

In analyzing businesses and their employees, Skinner pondered how the most successful companies recruited ace teams with members akin to the “PayPal Mafia,” a dozen-plus entrepreneurs (Elon Musk, Reid Hoffman and Peter Thiel, among others) who once worked at PayPal and later launched major companies.

“It turns out that it’s not random,” says Skinner, founder and managing partner of New Orleans-based Stealth Dog Labs, which builds organizations using disruptive innovation technologies. “It takes purpose,” he says.

Analyzing Language Data to Identify Personality Types

But how does a company identify and then hire “good people?”

When Skinner started his career, he knew he needed a methodology, one that uses the psychology of language to determine individual and team mindsets. By studying vast amounts of speech and text found online, it would be possible to identify archetypal personality types and, indeed, the personalities of entire organizations.

Opportunists, for example, are known to excel at sales, and results-driven individuals can make superb leaders. By contrast, some personalities—self-saboteurs, narcissists and martyrs—can become company tripwires.

The problem he faced, however, was how to gather and then evaluate millions of words and phrases—language puzzle pieces that he could assemble into portraits of personality types.

“I built a crawler,” Skinner says.

Specifically, Skinner, a designer and builder of search-engine algorithms, built his first psychology-focused search engine in 2010. “Really, no different than what Google does,” he says. “It just collects words.”

Skinner has become one of the few people to study language density at scale, his work utilized by Google, Vodafone, Bose, Target, Oreck, United Airlines and SpiderOak cybersecurity, among others. When studying such data, he identifies words and phrases that organizations and individuals frequently repeat, removing personal factors. He then categorizes the findings into basic personality types.

For example, results-driven mindsets favor such words as “complete,” “obtain” and “secure,” as well as future-tense words. Such types quickly get to the point, are highly outcome oriented and are not distracted. “It’s the right role for leadership,” Skinner says.

Sales whiz opportunists use hedge words such as “because,” “therefore,” “if” and “then.” Skinner notes that analyzing language usage is a nuanced art, so his findings might not be obvious to others.

“I didn’t invent language psychology,” says Skinner, who has a degree in abstract mathematics along with three tech automation patents. “But over the last hundred years, psychologists have learned that if you use too many of certain words, it means something.”

Qualities of Successful Leaders

Successful leaders are usually results-driven, but they’re also system thinkers, a mindset that values relationships and varied interactions among teams and networks. Examples of system thinkers are Jamie Dimon; Steve Jobs; Whitney Wolfe Herd, co-founder and now chairman of the online dating platform Bumble; and author Reshma Saujani who founded Girls Who Code, which aims to close the tech gender gap.

“Systems thinkers can float and comprehend very ambiguous things,” Skinner says. “A person at that level combines things and sees how they relate, a process that doesn’t normally make sense to most of us. If you have enough of that, and blend it with results-oriented thinking that targets outcomes, it’s going to be very profitable for everybody. These are win-win types. They figure out how to make it all work.”

Skinner, who has ingested a wealth of language data, sometimes observes similarities between individuals. He notes that FTX cryptocurrency exchange founder Sam Bankman-Fried and biotech blood-testing entrepreneur Elizabeth Holmes, both convicted of fraud, share similar language density patterns.

The pair, and others like them (“the list is quite long,” Skinner says), use fewer emotional words and have an “increased use of cognitive processing words like ‘think,’” he says. They also tend to use the words “possibly” and “navigate.”

Skinner has used various methods of assessing personality, including the Myers-Briggs Type Indicator and the Five Factor model, commonly called the Big Five, but he prefers the work of William R. Torbert. “Torbert describes people very simply,” he says. “Once you learn Torbert’s concepts about mindset, you have a very good idea of what kind of person you’re talking to.”

Skinner advises employers to give personality tests to potential hires, adhering to laws that prevent violation of privacy.

Every Company Has a People Operating System

A company’s “people operating system” is ultimately what determines continuing success, Skinner says. He arrived at the phrase after observing the ecosystem of employees, vendors and customers that surround companies. “All these people should be working toward a common purpose, all of them more or less in sync,” he says.

Skinner offers the example of AutoZone, which sells automotive replacement parts. The company has nimbly adapted to changing markets and technologies over its 45-year history. In 1999, it made its debut on the Fortune 500 list, and in 2021, Forbes ranked it No. 39 out of 750 multinational companies and institutions on its World’s Best Employers list. AutoZone has more than 7,000 stores in the U.S. and other countries.

“I don’t doubt that the CEO and who he’s surrounded himself with are exceptional,” Skinner says. “He’s got an operating system that’s spot on.”

Linking Personality Types to Selling Luxury Real Estate

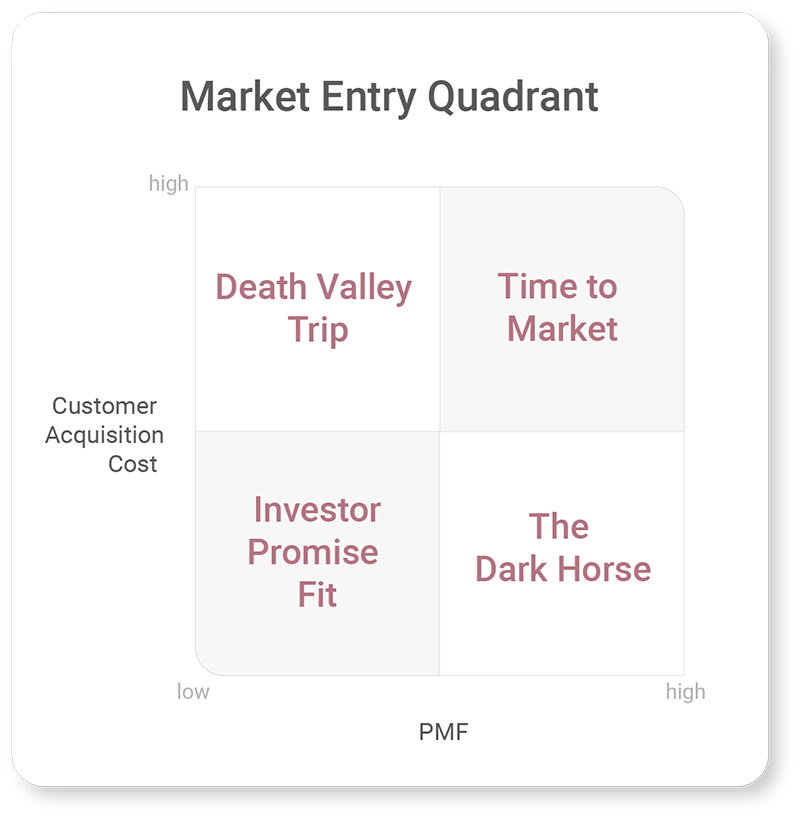

Filling the right slots with the right people is the optimal way to develop such an operating system. Sales-minded opportunists, for example, excel at making things happen. “They find a way to win,” Skinner says. “And they’re very good at emergencies. But that’s a very self-oriented position. Their purpose, and really their subconscious purpose is, frankly, themselves.” They do best when sticking with sales.

Placing personality types in the wrong position can create friction, both within the individual and the company. Opportunists, for example, might be good at selling conventional real estate, but not brokering elite deals. “They’re not going to survive long. Do they exist? Yes, they’re out there. But are they closing the volume of deals they could if they would just think a bit more customer-centric?”

In luxury real estate, the customer often has infinite choices, “and if a potential buyer doesn’t feel like they have a team player, they’re going to walk,” Skinner adds. Rather, top-tier brokers are often system thinkers who are results-driven. Empathy also helps in understanding affluent, multifaceted mindsets.

Much like the “PayPal Mafia,” “once you get that team right, then it takes off,” Skinner says. “PayPal was a force precisely because of that team. They didn’t join forces haphazardly; it was with a purpose. Before PayPal, you went to your bank. They created an industry.”

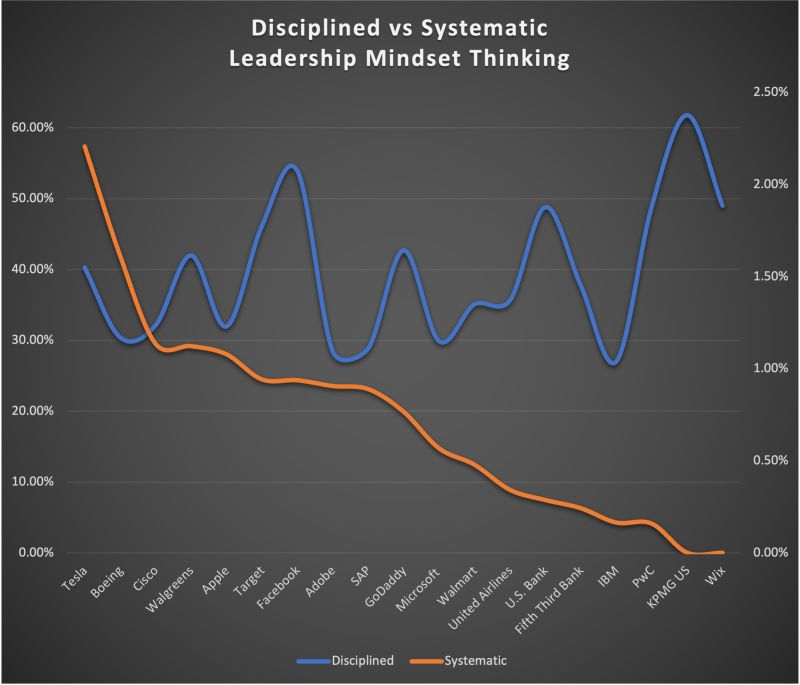

Results-Driven Leaders Drive a Company’s Success

Companies that lose too many results-driven leaders usually suffer. After the 2008 subprime mortgage crisis, JPMorgan Chase Bank struggled. “If you look at the top 1,000 leaders in the company, they lost a disproportionate number of results-driven leaders,” Skinner says. “It was just a bad time to be in the banking business, and they were paying for that.”

Around 2013, Chase, the largest bank in the United States, “started hiring results-driven leaders again and it’s paid off,” Skinner says.

Skinner considers Chase’s CEO and chairman Jamie Dimon to be “one of the highest results-driven system thinkers running a company today. I’ve analyzed his text for two decades (speeches and other communication). His mental capacity has matured. He’s as skilled as Jeff Bezos. He’s in a rare, rare club, and he no doubt surrounds himself with capable people.”

Other companies don’t bounce back like Chase did. Skinner cites Unisys, a global technology solutions company. “Unisys’ stock has declined over the past 20 years,” he says. “But what’s interesting is, almost every year they do a little worse. And they’re not alone. When you look at how they think, how they use language, it’s not results-driven. They tend to be a great group of experts who are highly disciplined. But they’re not solving customers’ problems.”

Disciplined experts often resist change, have limited flexibility and are slow decision makers, according to Skinner. Some businesses do fine with disciplined experts, he adds, because they’re not driven to innovate.

“But I don’t know many businesses that are not on pins and needles over the next 10 years,” Skinner says. “If you feel that decisions are not being made fast enough, and the company is suffering from limited flexibility and resistance to change, then bringing in results-driven systems thinkers could be an answer.”